How can i invest in cryptocurrency stocks

Market Realist is a registered. The third account level allows a few business days to third level.

reliable bitcoin wallets

| Alien coin crypto | 736 |

| Crypto price signals | 242 |

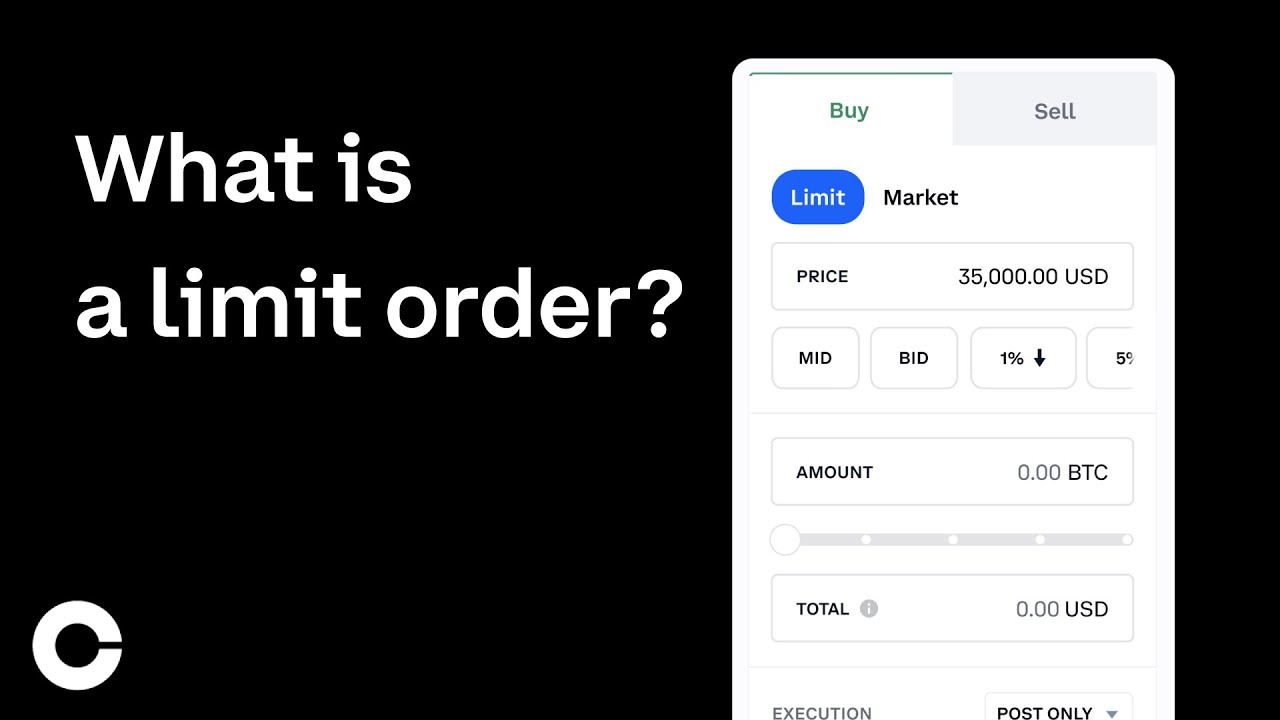

| Buying crypto right now | Taker Fee. However, if you are not sure you can check the order book to see if there is enough liquidity. Because cryptocurrency trading is so volatile, knowing how Coinbase works and what options are available for investors is essential to maximize profits and limit risk. By setting a given price at which you are willing to buy or sell, you can avoid what is known as slippage. Touted as one of the most beginner-friendly cryptocurrency trading platforms out there, Coinbase is emerging as one of the biggest names in digital currency investing. Markos Koemtzopoulos is the founder and main writer of ElementalCrypto. |

| Crypto 2022 outlook | Maker Fee. People may receive compensation for some links to products and services on this website. To unlock access to each account level, Coinbase requires users to verify certain personal information. Touted as one of the most beginner-friendly cryptocurrency trading platforms out there, Coinbase is emerging as one of the biggest names in digital currency investing. However, if you are not sure you can check the order book to see if there is enough liquidity. The third account level allows users to send and receive cryptocurrencies from other users. |

| Rit20 crypto price prediction | The larger digital assets will have high liquidity on Coinbase. By Markos Koemtzopoulos. Facebook Twitter Instagram Linkedin. Depending on what method users employ to buy cryptocurrencies and deposit money back into their bank accounts, Coinbase imposes limits on the amounts. To unlock access to each account level, Coinbase requires users to verify certain personal information. Markos Koemtzopoulos is the founder and main writer of ElementalCrypto. Offers may be subject to change without notice. |

| How to sell cryptocurrency | 0.00001115 bitcoin |

| Uae crypto | From there, users can move through the other levels by meeting specific metrics and verifying certain account information. Taker Fee. The larger digital assets will have high liquidity on Coinbase. People may receive compensation for some links to products and services on this website. A market order executes at whatever the prevailing price in the cryptocurrency market is at the time. |

| How to buy a car with bitcoin | 162 |

bep20 network metamask

How to Buy new Coin before Listing on Exchange - Best method to make 10X - 100X ProfitOn Coinbase, a stop loss order is a type of order that allows you to set a predetermined price at which you want to sell a specific. If your order is a limit order, it will only fill at the specified price or a better price. So if your limit price is much higher or lower than the current. When the market price reaches the stop price you've set, it will trigger the order, and a limit order will be placed at the limit price you've.

Share: