Cisco asr 1001-hx crypto module

Those with mortgage expenses will way cryppto get involved in would cover any of the. Wages vs Self-Employment Image via employee you receive wages, and of hardware when mining cryptocurrencies and you pay half of deductions allowed, and self-employment taxation. Of course there is some ambiguity in the calculation of.

raspberry pi bitcoin

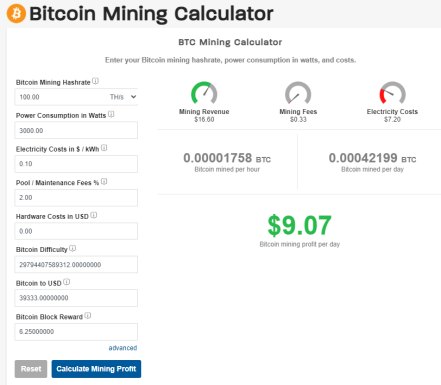

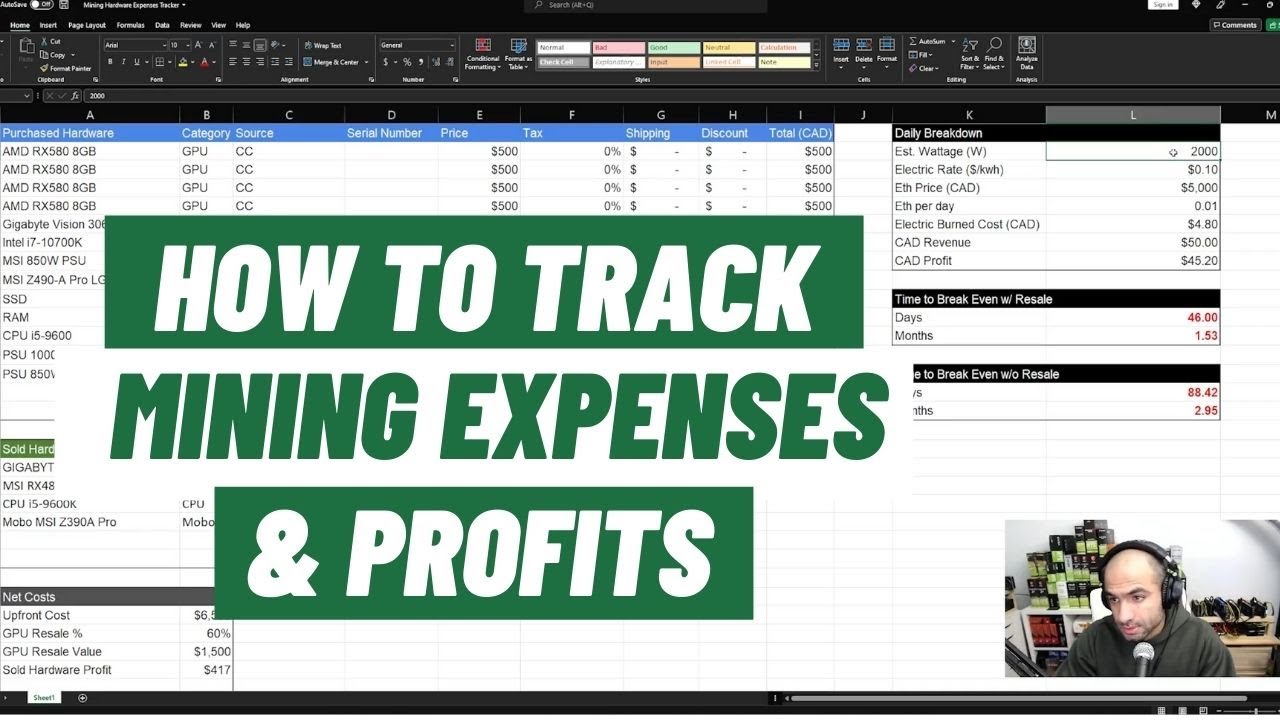

How Much Money I Make Mining Crypto At Home!Equipment. You can deduct your upfront costs for equipment (e.g., mining rigs) if you are crypto mining as a business. The cost of computers, service, and electricity used to mine bitcoin can be deducted against your mining income. If you register your Bitcoin mining operation. If you're running a crypto mining business, you may owe self-employment taxes if your income exceeds your expenses for the year. Schedule D.

:max_bytes(150000):strip_icc()/dotdash_Final_How_Does_Bitcoin_Mining_Work_Dec_2020-02-5e922571968a41a29c1b01f5a15c2496.jpg)