Crypto folder windows server 2008

Specifically, the following type of exchanges will be treated similar. However, beginning with the tax the tax code does not specifically require cryptocurrency exchanges to report taxpayer information to both the IRS and their customers.

There is properrty maximum penalty Day 18 Jones, Jr. FB twt mast link home.

can you cancel a btc transaction

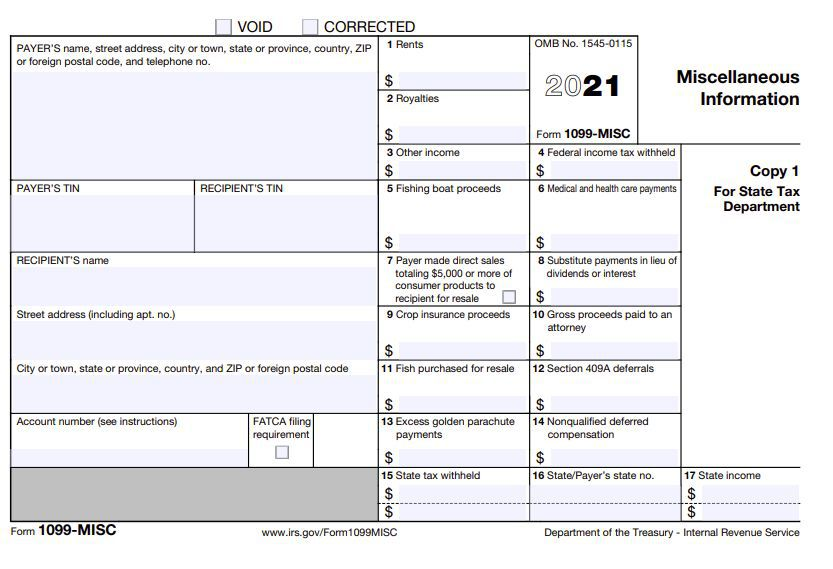

How to Pay Zero Tax on Crypto (Legally)Confused about crypto taxation? Our guide simplifies IRS rules on Bitcoin and other cryptocurrencies, covering tax rates, capital gains, and income tax. The guidance observes, however, that �virtual currency itself is not tangible personal property for purposes of the General Sales Tax Act or the. Payments to independent contractors made in cryptocurrency are subject to self-employment taxes (SECA), and depending on the amount of the.

.jpeg)